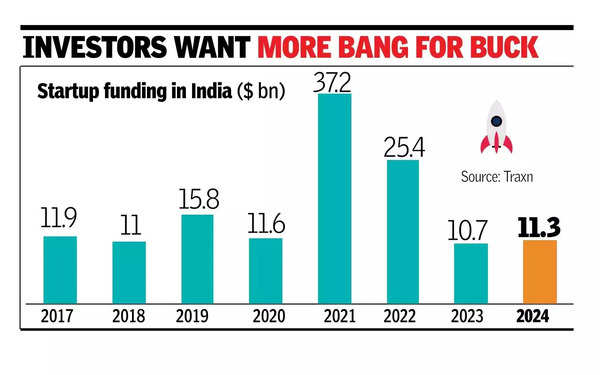

MUMBAI: After two years of funding slump, investments into India’s startups are seeing some revival. Investors infused about $11.3 billion into startups this year, a slight improvement from funding worth $10.7 billion recorded last year, data sourced from market research firm Tracxn showed. In the coming year, companies are expected to see a sizeable amount of funding cheques but the deployment of capital will be cautious, keeping in line with the trend seen for quite sometime now and late-stage deals (over $100 million) will take time to close, venture capital (VC) firms said.

Not to say that there’s a lack of capital-VC firms raised an estimated $2.5 billion in funding in 2024 alone compared to less than $2 billion in 2023 and some of them plan to raise new funds in 2025; but investors want to ensure they make the right bets. “As investors, we are very clear that we need to see a company’s path to profitability, we need to see good governance structures, assess firms’ go-to market strategies deeply and figure out founders’ ability to deliver. When you diligence all of these, it takes some time and investing capital takes longer,” Padmaja Ruparel, co-founder at IAN (Indian Angel Network) Group told TOI.

Quick commerce player Zepto led startup funding this year having bagged $1.4 billion in investments alone amid a surge in investor appetite for rapid deliveries.

A clutch of companies including PhysicsWallah, Rebel Foods, Eruditus and Purplle also managed to raise funding worth more than $100 million from investors. There were also few big secondary transactions like Lenskart’s $200 million round. In a secondary deal, shares change hands among a company’s investors and no money is added to the firm’s coffers. Funding was rather uneven across quarters, probably hinting at a measured pace of deal closures. Funding in the December quarter (so far), for instance, slipped to a three year low of $1.8 billion after touching $3.5 billion in the September quarter. “Funding patterns have evolved towards fewer, larger rounds,” said Neha Singh, co-founder at Tracxn.

Yet, the sheer size of the Indian market and the shift in consumption patterns towards better quality and more premium products creates growth opportunities for companies, making it an equally attractive bet for investors, industry experts said.

“There is no lack of belief in the fundamental opportunity that exists in India. Growth opportunities will always be exciting and India is a growth market,” said Sandeep Murthy, managing director at Lightbox India Advisors which plans to raise a new fund in the range of $200 million next year.