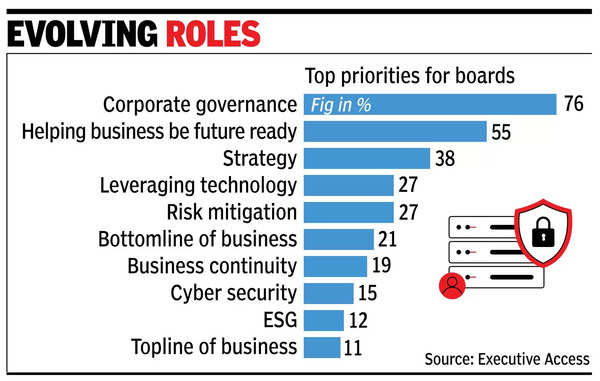

NEW DELHI: Boards have evolved significantly, looking beyond their traditional role in corporate governance to also serve as engines of growth, driving innovation and strategic decision-making. Five years ago, the focus was primarily on compliance.

This marks a shift from a passive, compliance-driven mindset towards a more proactive approach, where boards engage in substantive dialogue and encourage innovative thinking, a survey by global search firm Executive Access, commissioned by TOI, reveals.

In light of this, boards recognise the need for greater meritocracy in selecting members, especially in today’s fast-changing and volatile business environment. They are increasingly leaning on individuals of high calibre with necessary intellectual and professional breadth, the survey of 120 board members said.

“The survey indicates that boards today are more evolved and have moved beyond corporate governance. A well-structured, business-savvy board can significantly drive growth,” says Ronesh Puri, MD, Executive Access (India).

Additionally, talent is increasingly drawn to boards that embody strong values and foster open discussions. The survey examined how the role and focus of boards have evolved.

Harsh Goenka, chairman, RPG Enterprises, says, “In the past, corporate boards were often a mere legal formality, convened to tick the compliance box. Today, they’ve transformed into a powerful strategic necessity, pivotal in defining a company’s trajectory.”

“Leadership teams are no longer just seeking approval; they’re actively seeking guidance and insights from the board. Boards are expected to help open new doors, leverage their networks, and provide strategic connections. Today, it’s about ensuring technology is harnessed, strategies are implemented, and succession planning is robust,” he adds.

In the BANI (Brittle, Anxious, Nonlinear, and Incomprehensible) world, preparing businesses for future has become crucial. The advent of AI has increased risks compared to a decade ago, and the potential for innovation to disrupt or even render a business obsolete is significant. As a result, board members are more concerned about business continuity than ever before.

Nikhil Ojha, partner at Bain & Co and head, strategy practice, Asia Pacific, says, “Many board members now recognise their fiduciary responsibility not just in terms of defensive “do no harm” but also as stewards of shareholder value creation agenda. They are, therefore, holding management accountable towards driving full potential from the core, and also growing new Engine-2 businesses.”

Another key finding is that due to the funding winter and heightened investor focus on profitability, board members now believe the bottomline is significantly more important than chasing topline growth.

Just two to three years ago, during the valuation boom, more companies prioritised topline growth. Companies such as Byju’s and Paytm have paid a heavy price for focusing solely on topline growth, the expert added.

Some like Siraj Chaudhry, who serves on boards of Jubilant Ingrevia and Carrier Air Conditioning, believe that the transformation aligns with the broader changes at India Inc.

The board has to be mindful that the key management personnel are completely aligned. Hence, the role of the Audit and Risk Management Committee has become increasingly critical, notes Daljit Singh, former president, Fortis Healthcare.