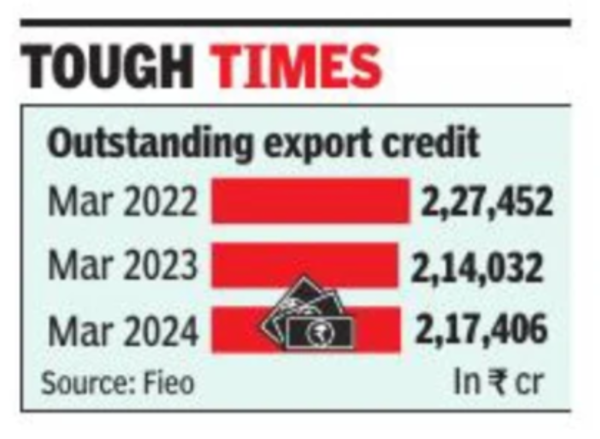

Industry lobby group Fieo has flagged credit flow as a key concern, pointing out how exporters were battling a credit crunch despite the requirement for loans rising over the last two years on account of higher commodity prices, increase in freight rates due to tension in West Asia and Red Sea, which had considerably increased the voyage time and delayed payment.

Tough times

While exporters have been raising the red flag on the issue, govt and RBI have failed to act on for several months. The issue is expected to come up again during the meeting of the Board of Trade, led by commerce and industry minister Piyush Goyal, later this week.

An industry expert said that the post-Covid guarantee-based loans had helped industry get credit but things have changed drastically. “The lack of collateral free and non-recourse finance is a big challenge,” said a source. Banks framing their own policies is seen to be a key stumbling block. Fieo has proposed additional support from Export Credit Guarantee Corporation and higher interest subsidy, sources said.

High logistics cost and higher cost of credit are seen to be key challenges confronting Indian exporters, a sharp contrast to other countries such as Canada, Italy and the UK, not to mention China. Indian exporters are of the view that they are poised to capitalise on the China Plus One strategy but additional funding is a pre-requisite.