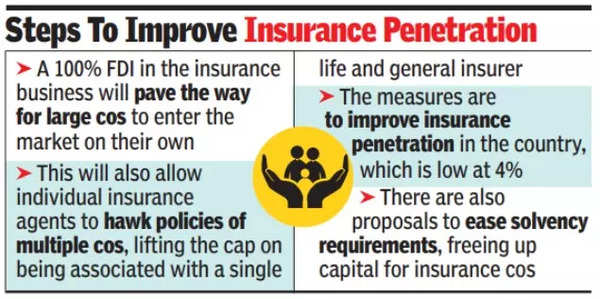

NEW DELHI: Government is all set to allow 100% foreign direct investment in insurance business, paving the way for large companies to enter the market on their own, while allowing individual insurance agents to hawk policies of multiple companies, lifting the cap on being associated with only one life and general insurer.

The twin measures are part of the Insurance Amendment Bill that is proposed to be introduced during the winter session of Parliament that kicks off later this month.

On August 19, TOI was the first to report about the proposed increase in the FDI ceiling, a suggestion which was publicly made by Insurance Regulatory & Development Authority of India (Irdai) chief Debasish Panda earlier this month, linking it with “Insurance For All by 2047”.

While the current ceiling for insurance companies is 74%, for intermediaries, the cap has already been eased. There are currently two dozen life insurance companies, 26 general insurers, six standalone health insurance outfits with General Insurance Corporation being the sole reinsurer.

To allow more companies to underwrite policies

The two proposals are part of the strategy to improve the insurance penetration in the country, which is low at 4%, by allowing more companies to underwrite policies, while also unleashing agents to sell covers, both life and general. Currently, agents are already offering products of multiple companies but instead of doing it directly, they have got their spouse or other family members to register as agents for other companies.

The assessment in the govt is that the large Indian players – ranging from SBI, ICICI and HDFC Bank to the Tatas and the Birlas – are already entrenched and given that life insurance is a long-gestation, high investment business, there may not be too many domestic companies with deep pockets to invest. Besides, some of the large players such as Allianz is looking at parting ways with Indian partner Bajaj Finserv and may enter on its own.

In addition to raising the FDI ceiling other stipulations on directors are also proposed to be eased, sources said.

Several other amendments are also planned. For instance, Irdai has proposed amendments to allow for issuing composite licenses, a move that will benefit the likes of state-owned Life Insurance Corporation of India, which is keen on acquiring a health insurance outfit to expand its product portfolio. If the proposal goes through, the same company can issue life and non-life covers.

Similarly, there are proposals to ease the solvency requirements, freeing up capital for insurance companies.