MUMBAI: The rupee sank to an all-time low of 84.50 against US dollar on Thursday, declining 0.1% during the session and 1.5% this year. The currency’s weakness was primarily driven by foreign fund outflows from Indian markets and heightened risk aversion linked to escalating geopolitical tensions, particularly the ongoing Russia-Ukraine conflict.

The rupee declined by 8 paise even as an article co-authored by RBI deputy governor Michael Patra and published by RBI contested IMF’s decision to de facto classify India’s exchange rate policy as a ‘stabilised arrangement’ for December 2022 to October 2023. During this period the central bank ensured that the exchange rate was stable through interventions.

RBI described the IMF move as ‘ad hoc, subjective, an overreach of its central purpose of surveillance of member countries’ policies and tantamount to labelling’. The article argued that RBI’s intervention in the foreign exchange market should be measured relative to size of GDP. “It is found that RBI’s net interventions to GDP averaged 1.6% during Feb to Oct 2022, as against 1.5% during earlier crises, which were of much lower magnitude,” the article said.

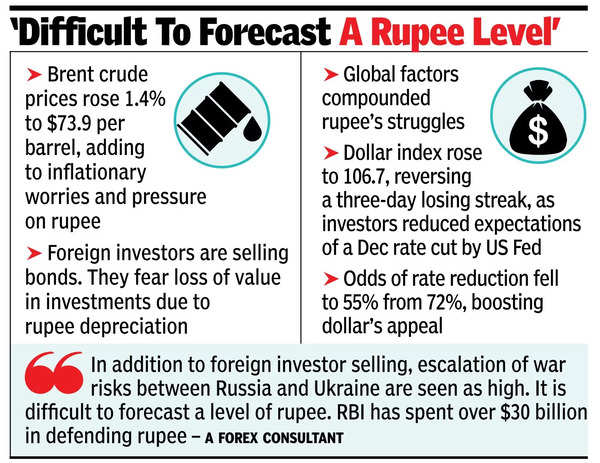

Indian equity markets faced turbulence, with BSE sensex falling 0.5% and Nifty 50 sliding 0.7%. A sharp selloff in Adani group shares added to the market’s woes, with Adani Enterprises plunging over 20%. FIIs sold Rs 3,412 crore in equities on Tuesday, further straining market sentiment. Bond markets were not spared either, with foreign investors offloading Rs 10,400 crore worth of bonds this month, primarily instruments included in JPMorgan’s emerging market debt index.

“In addition to foreign investor selling, escalation of war risks between Russia and Ukraine are seen as high. It is difficult to forecast a level of the rupee. RBI has spent over $30 billion in defending the rupee,” said KN Dey, a forex consultant.

“Today it is not just dollar strength but also rupee weakness because of outflows from the Indian market,” he added.