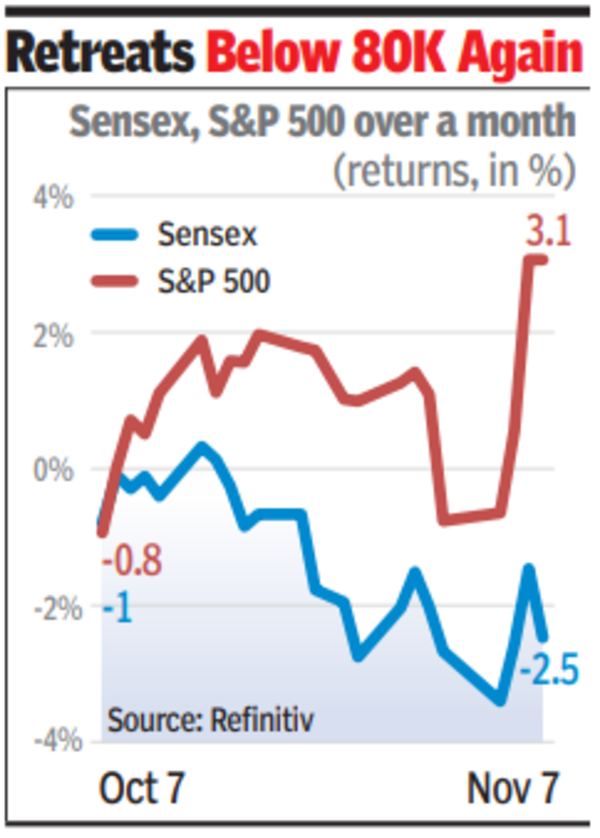

MUMBAI: The sensex on Thursday tanked 836 points as the euphoric rally stemming from Trump’s win in the US presidential election dissipated.

The benchmark index retreated below the 80K mark again to settle at 79,541 points as foreign portfolio investors offloaded Indian equities worth Rs 4,889 crore. On the other hand, domestic institutional investors remained net buyers, net buying shares worth Rs 1,787 crore, BSE data showed.

The domestic market ended with a deeper cut that eroded the previous session’s gains due to disappointing quarterly numbers by Indian companies and persistent selling by FPIs, according to Vinod Nair of Geojit Financial Services. “The broader market saw a widespread selloff as optimism over Trump’s election victory waned. However, investors are now shifting their attention to the upcoming Fed policy meeting and domestic public outlay, which are anticipated to offer more insight into the future trade path.”

The US Federal Reserve is widely expected to go for another cut in interest rates in the world’s largest economy. The magnitude of the cut this time – at 25 basis points (100 bps = 1 percentage point) is anticipated to be smaller than the 50 bps cut in Sept.

The day’s slide on Dalal Street left investors poorer by Rs 4.2 lakh crore, with BSE’s market capitalisation now at Rs 456.1 lakh crore, official data showed.

The global markets also traded mixed the day after the US presidential election results were out. Nikkei in Japan was marginally down, while Hang Seng and Dax (Germany) were both up about 2% each, and Shanghai Composite was up 2.6%.

The crypto market continued to rally with Bitcoin trading over the $76K mark for the first time in history.