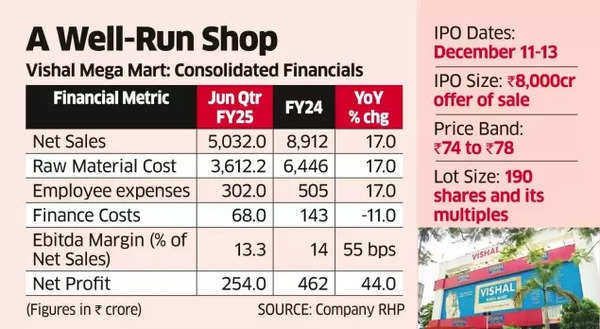

Vishal Mega Mart IPO: The supermarket chain Vishal Mega Mart is set to launch its initial public offering (IPO) on December 11, seeking to raise Rs 8,000 crore through an offer for sale (OFS).

The public subscription for Vishal Mega Mart IPO commences on December 11 and concludes on December 13, with share allotment scheduled for December 16. Trading of shares will begin on December 18 at both BSE and NSE exchanges.

The IPO structure consists entirely of an OFS, with the company not receiving any direct financial benefits from the issue.

Vishal Mega Mart IPO GMP

The company’s shares are presently showing a grey market premium of roughly 31%, with the current GMP at Rs 24, according to an ET report.

The robust grey market performance indicates substantial interest, as the present GMP of Rs 24 suggests a potential listing premium of about 31%. The current GMP demonstrates growth from Rs 17 observed during the weekend, the report said.

Vishal Mega Mart IPO: Price Band & Other Details

For its IPO, the retail chain has established a price band between Rs 74-78 per equity share. The Rs 8,000 crore book-built issue comprises solely an offer for sale (OFS) of 102.56 crore shares.

Vishal Mega Mart IPO

Retail investors can apply for a minimum of 190 shares, requiring an initial investment of Rs 14,820.

For small non-institutional investors, the entry requirement stands at 14 lots (2,660 shares), necessitating Rs 2.07 lakh. Large non-institutional investors must invest in at least 68 lots (12,920 shares), requiring Rs 10.07 lakh.

Vishal Mega Mart IPO: Should you subscribe?

At a projected market capitalisation of approximately Rs 35,168 crore, the company’s IPO is valued at 71 times its projected FY25 earnings. This valuation appears more modest compared to its primary retail competitors, with Avenue Supermarts (DMart) trading at a PE multiple of 92 and Trent commanding a higher multiple of 137, says an ET analysis.

Considering Vishal Mega Mart’s established market position, operational scale and focus on serving its target demographic, the IPO presents an attractive investment prospect despite its aggressive pricing, the ET analysis says. It offers investors an avenue to participate in the expanding consumption patterns across India’s smaller cities and towns.

About Vishal Mega Mart

Established in 2001, Vishal Mega Mart operates as a fashion-focused hypermarket chain throughout India. The retailer provides home and kitchen appliances, travel items in its General Merchandise division, whilst its Food and Groceries section offers FMCG products and household essentials. A notable ownership transition occurred in 2018 when Partners Group of Switzerland and Kedaara Capital from India acquired controlling interest.

The company’s retail footprint, as of September 30, encompasses 645 franchise outlets across 414 cities, utilising more than 11 million square feet of retail space.

The company’s current market value stands at Rs 35,168.01 crore, with FY24 showing revenue growth of 17.41% and profit after tax increasing by 43.78%.

KFin Technologies serves as the IPO registrar, whilst the issue management team includes Kotak Mahindra Capital Company, ICICI Securities, Intensive Fiscal Services, Jefferies India, JP Morgan India, and Morgan Stanley India.